EFIG Continuously Expanding its Nationwide Presence!

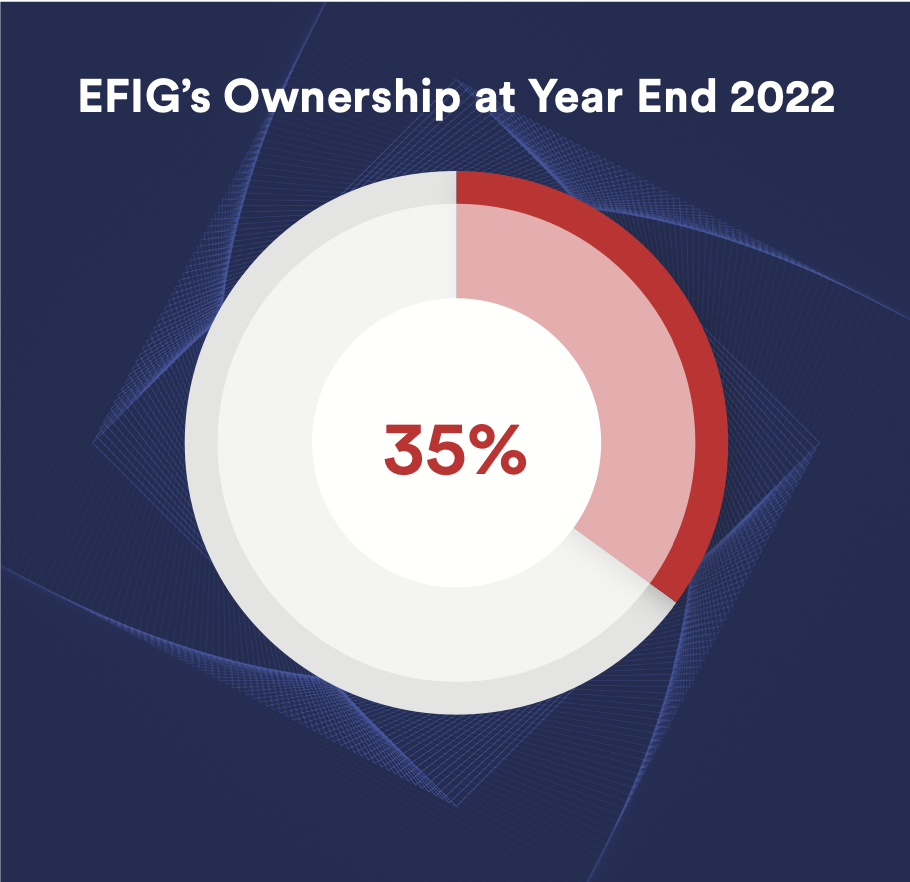

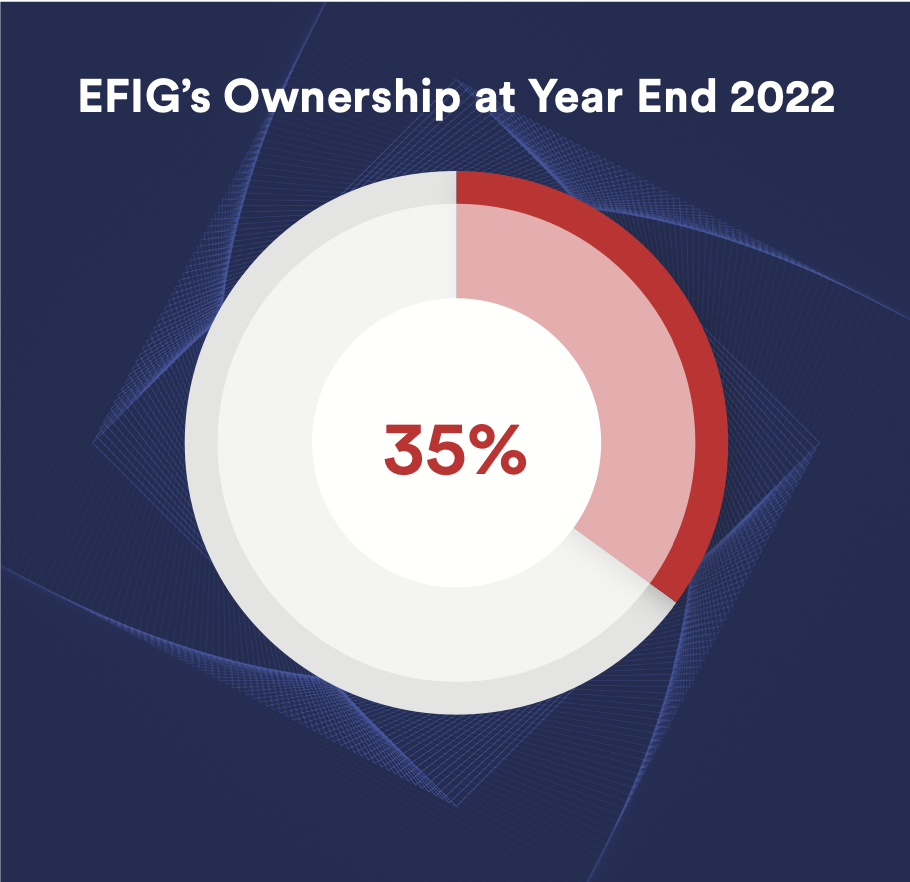

by strengthening its capabilities through targeted investments in the network infrastructure. As of 2022, eFinance held stakes in eight ancillary investments, providing the Group with footholds within dynamic economic sectors, reinforcing its position as the public and private sectors’ digital partner of choice, establishing stable sources of supply and demand for the Group’s subsidiary network, and supporting the creation of products that benefit citizens and economies by facilitating financial inclusion and digital transformation.

EFIG's Investments

Launched in 2020, eTax is an entity created for the purpose of managing and operating the government’s electronic tax system alongside the ETA and the Real Estate Taxation Authority (RTA). eTax invests in state-of-the-art technologies to streamline the government tax processes, targeting various key areas in support of the ETA’s strategy for strengthening tax operations and greatly enhancing existing services.

eTax develops innovative digital solutions that automate the entire tax process, from registration and filing to collections and conflict resolution, with the goal of achieving operational efficiencies across the board, strengthening the government’s ability to generate tax revenues, and supporting the sustainability of the government’s tax system. The company offers various solutions that efficiently manage the ETA and RTA’s electronic tax systems.

Core Taxation Systems:

- e-Invoice

- e-Receipts

Established in 2021 with the aim of developing platforms for the purpose of digitalizing national health insurance delivery, eHealth capitalizes on eFinance’s existing presence in Egypt’s dynamic and rapidly developing healthcare sector. eHealth is responsible for managing and operating technological services on behalf of Egypt’s Universal Health Insurance (UHI) program, which is being gradually rolled out across governorates and aims to provide health insurance coverage to all Egyptians over the next decade. On this front, eHealth has already signed its first contract in 2022 to connect six million people across five governorates with more than 140 medical units.

Additionally, eHealth will offer specialized and integrated digital services to the broader healthcare and insurance sectors, with solutions extending from daily management and operation of technological systems to specialized technical support. eHealth will also provide artificial intelligence solutions for analytics and data analysis, developing smart information systems and decision-support services.

In parallel, the company will also manage the multipurpose Citizen’s Card alongside eFinance subsidiaries, banking institutions, and the relevant medical authorities.

Misr Technology Services (MTS) is a trade and transport logistics platform established under a strategic private-public partnership between the Egyptian government and private sector stakeholders in 2015. MTS holds a 20-year contract with the Egyptian Customs Authority, mandating the company to digitize the Authority’s operations and establish a national technological platform covering airports, seaports, land borders, and free zones.

MTS leverages best-in-class ICT solutions and systems integration processes to provide its partners in the trade community with a selection of electronic services, rapid process automation, and an integrated package of value-added services informed by highly developed data analytics and functionality, providing decision makers with accurate and timely analyses.

Misr for Government Technological Services (e-Serve) was founded in 2017 with the purpose of pioneering the use of digital tools in streamlining government service provision and delivering a G2G platform for the integration and exchange of national-level data resources. e-Serve connects strategic entities and organizations through an enterprise service bus (ESB), a secure gateway that ensures that government service providers receive every request made by digital consumers through an interlaced G2G platform that notifies all entities of each change at a given node of the network.

Additionally, e-Serve has developed Khadamat Misr, a user-friendly mobile application that allows Egyptians to request a wide selection of services from various governmental entities and follow up on their requests. Khadamat Misr caters to regular consumers, real estate owners, businesspersons, and citizens seeking to obtain ID documents. e-Serve has also spearheaded the digitization of learning resources for Egypt’s public education system, setting up an efficient, user-friendly learning platform that integrates curricula, assignments, tests, evaluations, and grading.

Delta Misr Payments (DMP) was established with the purpose of advancing the government’s objectives of expanding access to the formal financial system and minimizing reliance on cash for everyday transactions through the promotion of e-payment systems. DMP has developed integrated e-payment infrastructures for electricity and water utilities, providing the Ministry of Electricity and Energy with a network of prepaid and smart meters. DMP is also currently contracted with the New Urban Communities Authority to create a network of prepaid water meters. Furthermore, the DMP provides e-payment services for its clients through mobile applications and other payment methods. DMP also develops NFC technologies that allow consumers to charge prepaid cards and meters through mobile applications.

Alameia for Consulting and Information Systems (ACIS) enters contracts with third parties for the provision of IT advisory services. The company’s service suite comprises the design, implementation, and development of a comprehensive range of information systems, communication networks, and microfilms. In addition to extending management advisory services, ACIS installs and maintains information networks and databases. The company also provides researchers, institutions, and a number of other establishments with data solutions.

In 2022, eFinance concluded a USD 10 million investment in Nclude by Global Ventures, a venture capital fund focused on investing in early- and growth-stage Egyptian fintech and fintech-enabled companies, as well as fintech start-ups based in the MEA region that are looking to expand to Egypt. The investment in Nclude aligns with the Group’s commitment to investing in and supporting Egypt’s thriving fintech ecosystem.